|

| |

| 10 Things to Consider When Buying a Vehicle |

| |

|

1. Needs vs. Wants |

| Create a list of features you have to have versus a list of features you would like to have. It's good to distinguish between what you can't live without and those extras that would be nice. |

| |

|

| |

|

| |

| 2. Option |

|

| Calculate pricing for options by both a la carte and package deals. If you only want one option in the package, it's probably cheaper to buy it by itself. |

| |

| |

|

| |

| 3. Resale Value |

|

|

|

You probably won't keep the car forever, so it is worth

considering the resale value. |

|

| |

|

| |

| 4. The Driving Experience |

|

| Calculate pricing for options by both a la carte and package deals. If you only want one option in the package, it's probably cheaper to buy it by itself. |

| |

|

| |

| 5. Insurance Costs |

|

| Calculate pricing for options by both a la carte and package deals. If you only want one option in the package, it's probably cheaper to buy it by itself. |

| |

| |

|

| |

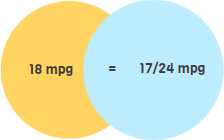

| 6. Fuel Efficiency |

|

| Although it's important, don't get too worked up about fuel efficiency. A vehicle rated 18 mpg combined compared to one that is 17/24 mpg only saves $122 each year according to fueleconomy.gov. |

| |

| |

|

| |

| 7. Safety Rating |

|

|

Look up online to see how well a vehicle performed in a safety rating test, and then choose one with high results.

|

| |

| |

|

| |

| 8. Financing Rates |

|

|

Work on building your credit score. A credit score of 720 or above will provide the best interest rates for car loans, a score of 620 and below result in much higher rates.

|

| |

| |

|

| |

| 9. Online Specials |

|

|

Visit dealership websites or Facebook pages for internet specials or other promotions.

|

| |

| |

|

| |

| 10. Warranty |

|

| Choose a warranty that is useful to you. A warranty that covers both normal use and other things such as A/C, battery, etc. is ideal. |

| |

|

| |